- Joined

- Oct 14, 2014

- Messages

- 1,971

To those guys who're retiring soon, what are you finding out there for health insurance? My plant is slated to close in ten years so I have time before I retire but I've heard horror stories about the insurance costs.

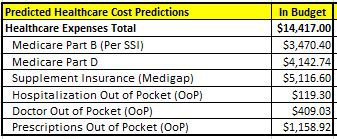

We are talking Obama care here. It all depends on your AGR, adjusted gross income. For my wife and I, in Minnesota, the Obama care credit started phasing out at $36000 and was completely gone by AGR $70,000. Below the bottom number and insurance was not too bad. Check me but you are in the $4K per person per year range - but BIG deductible. Now we were over the top number when Obama care first started and the bill was $15K per person per year with 6K deductable that we always had to pay because of our medical issues.

In our specific case it made sense to drop our income by 40K per year to save 30K a year in Obama care, income, and self employment taxes. So we closed 1/2 our business and in effect semi retired early.

Now we are on medicare, premium is only about $4K a year for both of us - cheap. Decent deductibles too.

ANYWAY TAKE HOME MESSAGE - BE SURE YOU KNOW WHAT YOU ARE LOOKING AT HERE. I'd pay a tax accountant to run the numbers for you.