- Joined

- Jun 12, 2014

- Messages

- 4,824

Taxes in the US are much higher than just the 25%, Feds take 20-30% (or more), than you have state tax so add another 5-10% if you live in CA, then you have sales tax which in CA it is another 9-10%, if you work they withdrawal for social security, medicare, etc.. If you own a house then you are taxed on its value, and then they add on dozens of bonds that will not get paid off for decades. You then have medical insurance, and even if you are on Medicare you have to pay supplemental insurance to cover what they do not pay. Rent a car at an airport and 2/3rds is fees and taxes, the list goes on. My wife and I are retired, I still do some medical consulting, I figure at least 40% of what comes in goes out in taxes/fees. So one way or the other unless you are on a bare bones income, taxes take a big byte out of your income/retirement.

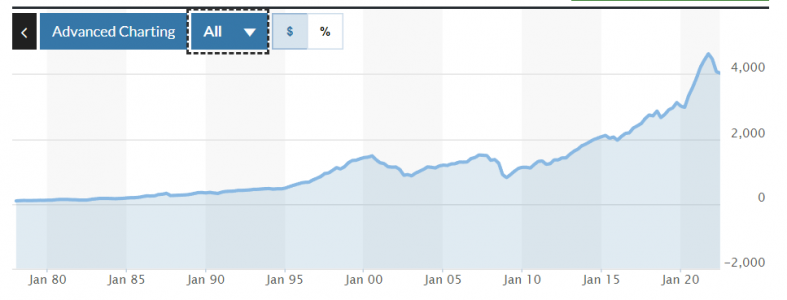

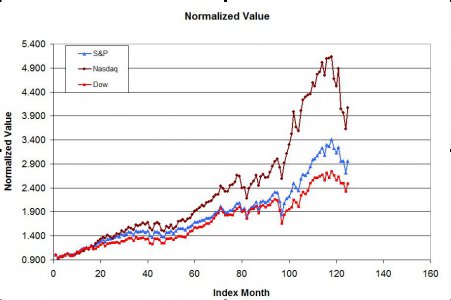

Primary thing for retirement is to be diversified in your income streams, the future is pretty grim with this respect even if you start at an early age. I look at my 401/403b and they haven't substantially grown through the years other than what I put in, and every time the market takes a dump you loose 20% or more of the value and then wait years for it to come back. We'll we are getting to the age where I may not be here long enough for that to happen. High yield savings accounts are a bit of a joke these days, they were at 0.5% until recently and then they turn around and charge you 20-30% on credit card debt, there is a reason why they hand credit cards out like candy.

Primary thing for retirement is to be diversified in your income streams, the future is pretty grim with this respect even if you start at an early age. I look at my 401/403b and they haven't substantially grown through the years other than what I put in, and every time the market takes a dump you loose 20% or more of the value and then wait years for it to come back. We'll we are getting to the age where I may not be here long enough for that to happen. High yield savings accounts are a bit of a joke these days, they were at 0.5% until recently and then they turn around and charge you 20-30% on credit card debt, there is a reason why they hand credit cards out like candy.