- Joined

- Feb 15, 2020

- Messages

- 375

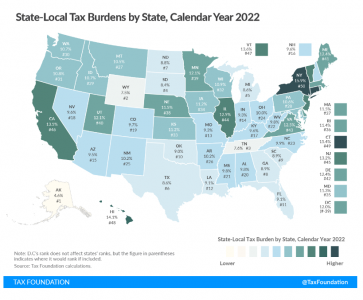

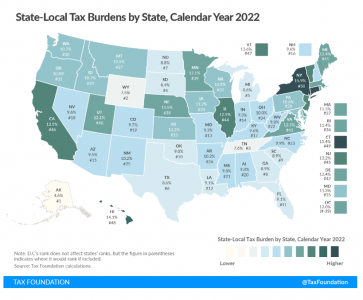

Here in IL property taxes are decided local goverments and school boards and are base on 1/3 of the assessed values of the property. I think my cumulative rate last year was about 8.6%. Sales taxes are set by local governments and the state and vary depending on what is purchased. Gas is taxed at about 20 cents/gal by the state over the federal tax rate.

No personal property taxes are allowed in the state constitution.

I can't keep it straight but I've still got to eat.

Eric

No personal property taxes are allowed in the state constitution.

I can't keep it straight but I've still got to eat.

Eric