I guess fortunately for us, the total value of what's in my shop is less than 1% of our total estate. There won't be too many arguments between our 2 kids as to who gets the tools; more likely there'll be arguments over who's going to have to get rid of them! I was executor of my parent's trust; things went VERY smoothly with my sister. We both did okay relative to our parent's estate which was about 25% of what my wife and mine worth was at the time. For my sister and bro-in-law, maybe 15% of their total worth. Do the divide by two and it's not chump change, but it wasn't lifestyle altering either.

I learned a lot and have a list of stuff I had to do as my wife is her parent's trust executor (eventually). Things like publishing a "notification of death" in our local paper for any creditors. Any creditors had 90 days to file a claim with me, otherwise the debt would go unpaid. Without that notification, me as the executor would be responsible for any debts my parent's had for my lifetime.

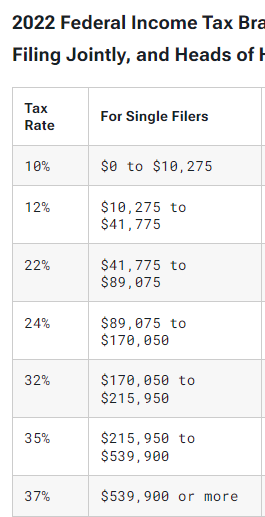

I had a little surprise when doing the trust's taxes (form 1041). My mom passed away on 5/13/2022, I divided the majority of their liquid assets between my sister and me around 6/10/2022. When my mom died on 5/13, all of her assets became property of the trust. Her income from Social Security, my dad's pension, and an annuity were maybe $50K a year in income. She also had around $600K in a brokerage account. If it made 10% that year, or a gain of $60K, it would have put her just into the 24% tax bracket.

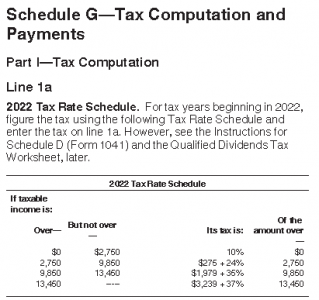

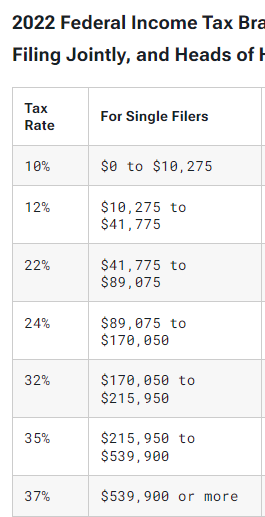

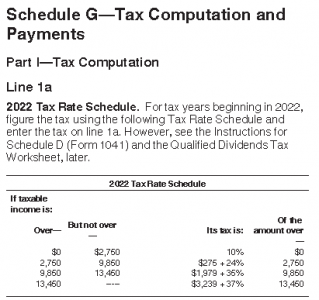

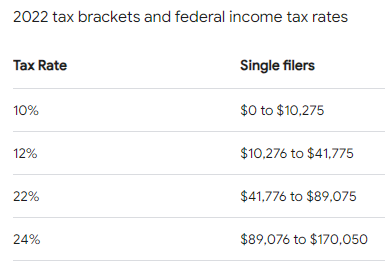

What I didn't realize, and was glad I got the money to my sister and me relatively quickly, was that the same $60K gain in her brokerage account, had it been in the trust, would have been mostly taxed at a 37% rate. Trust taxes hit the 37% rate (in 2022) at $13,460. Individual earnings needed to be over $539,900 to hit the same 37% rate. Holy carp, they really like taxing gains on income held in a trust! I guess it's an incentive to liquidate the trust and quickly as possible!

Individual Federal tax brackets for 2022

Trust Federal tax brackets for 2022